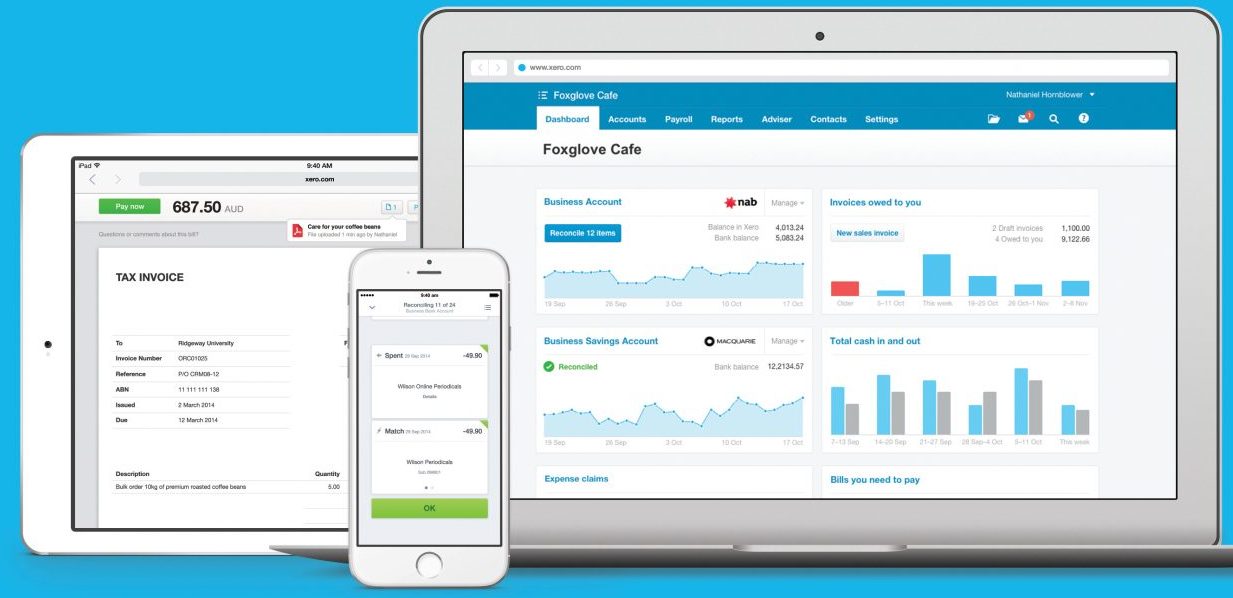

See your finances instantly!

Why not have a system where you can see from a Dashboard of money coming in and money going out? It makes sense so you can run your business finances effectively.

Are you still using Spreadsheets?

Are you still using spreadsheets? If you are an employer, you will be required to start Single Touch Payroll so you will need accounting software to report your payroll to the ATO. Another advantage of online software is to run your reports for example Profit and Loss to see how your business is running. You can also see what money is owed to you by your customers to improve

Superannuation is a big deal!

With the new Single Touch Payroll system in, the ATO is now receiving data from the Superfunds and will match it to the payroll records. Penalties have ramped up as well as the ATO audits for unpaid Super. Employers not doing the right thing can expect a visit from the ATO.

New Financial Year for your tax return

Maintain separate business and personal records. Have a separate bank account for business transactions only. Keep your records for 5 years. Set aside time to review and update your records Keep records electronically wherever possible. Software can help you report income and claim expenses correctly. ATO Small Business Newsroom

Xero billing scams

Be aware of your Xero billing invoices. Your Xero invoices will have your business name on them and will not be sent as "Dear Client". Do not click on the link unless it shows your business name. Xero has said the following:- Note: we have recently seen fake Xero subscription invoice emails being sent out by scammers. A genuine Xero subscription invoice email: Will be addressed to your billing contact

MYOB Accountright 2019.2 Upload for Single touch payroll

MYOB Accountright 2019. Ive met with 2 new clients that have the latest version of MYOB on their computer but its Local library (desktop) only. If you have employees, you will need to start Single Touch Payroll by 1st July 2019 as it is now tax law. https://www.ato.gov.au/Business/Single-Touch-Payroll/ To do this your MYOB accountright file needs to be uploaded as an "online" version. This can take some time to upload

Be aware of Phone ATO Scams!

PHONE SCAM ALERT! Listen out for suspicious calls claiming to be from the ATO. Scammers are ‘spoofing’ our phone numbers so it looks like the ATO are calling. They’re also leaving our numbers on voicemails to make their contact seem real. While these calls may appear to be from us, remember that we’ll never: • threaten you with arrest • demand immediate payment, particularly through unusual means such as bitcoin,

Single Touch Payroll

Are you ready for Single Touch Payroll? Single Touch Payroll (STP) is compliant from 1st July 2019. Since 1st July 2018, employers with 20 or more employees have reported to the ATO through their payroll software. On 12th February, 2019, it was passed to extend STP for those with 19 or less employees from 1st July 2019. Micro-employers (1-4 employees) will be allowed to rely on a registered BAS Agent

What Tradespeople want from their bookkeepers

Are you looking to save time? If you are doing your accounts on paper, or using spreadsheets you can save more time with online accounting software. You also get a clear picture of how the business is performing. Simple pricing budgets You can have a fixed monthly price to include your software and all the accounting (you don’t have time for) to clean up your current messy paperwork. With the ATO

Top GST mistakes in BAS reports

It's easy to make a mistake when preparing your BAS. That's why a certified bookkeeper/BAS Agent would be valuable in ensuring the ATO reporting is correct. Many business owners make mistakes on the Hire purchases/Lease of Vehicles or Plant & Equipment on their BAS. Incorrect tax codes in your chart of accounts - this affects the reporting on the BAS. Claiming GST on ALL expenses when some do not have

Why do you need a Registered BAS Agent?

A qualified bookkeeper can save you on time and processing the receipts, payments and expenses is only part of the job. They also have to review the numbers on the reports so they make sense for the business. They are keeping in touch with the ATO's latest rules and ensuring clients are compliant to deadlines. A Registered BAS agent can do all this for you and take care of speaking

Starting a New Business?

When you start a business, there are tax and super responsibilities you need to be aware of, including: the tax implications of your business structure whether you're entitled to an ABNExternal Link registering your business records you need to keep deductions you can claim. Before you get started there are a few things to consider when your tax and other obligations start - this will depend on whether you are

How to choose the right Bookkeeper for your business

Efficient, knowledgeable and organised A good bookkeeper understands your business processes, your industry and what is required for your business. Bookkeepers make sure processes are in order to provide you with necessary reporting so you meet the ATO deadlines. We have an excellent eye for detail and care about keeping your records up to date and accurate. Trust & Confidentiality Trust is essential for both parties. The relationship needs to

Do you have an employee or sub-contractor?

When hiring you must check first whether they are an employee or a contractor. Its important because it can affect your tax and super obligations. Penalties may apply if you do not get it right. You can use the ATO Employee/contractor decision tool to help you decide. ATO employee decision tool Link

7 Ways Xero makes your business & life better

https://youtu.be/zGiLLSQMbrQ If you would like a summarised copy of this video in PDF form - you can Download it by clicking PDF